All Categories

Featured

Table of Contents

The are whole life insurance and universal life insurance. The cash money worth is not added to the fatality advantage.

The policy finance interest rate is 6%. Going this course, the interest he pays goes back right into his plan's money value instead of a monetary organization.

Infinite Banking Concept Wikipedia

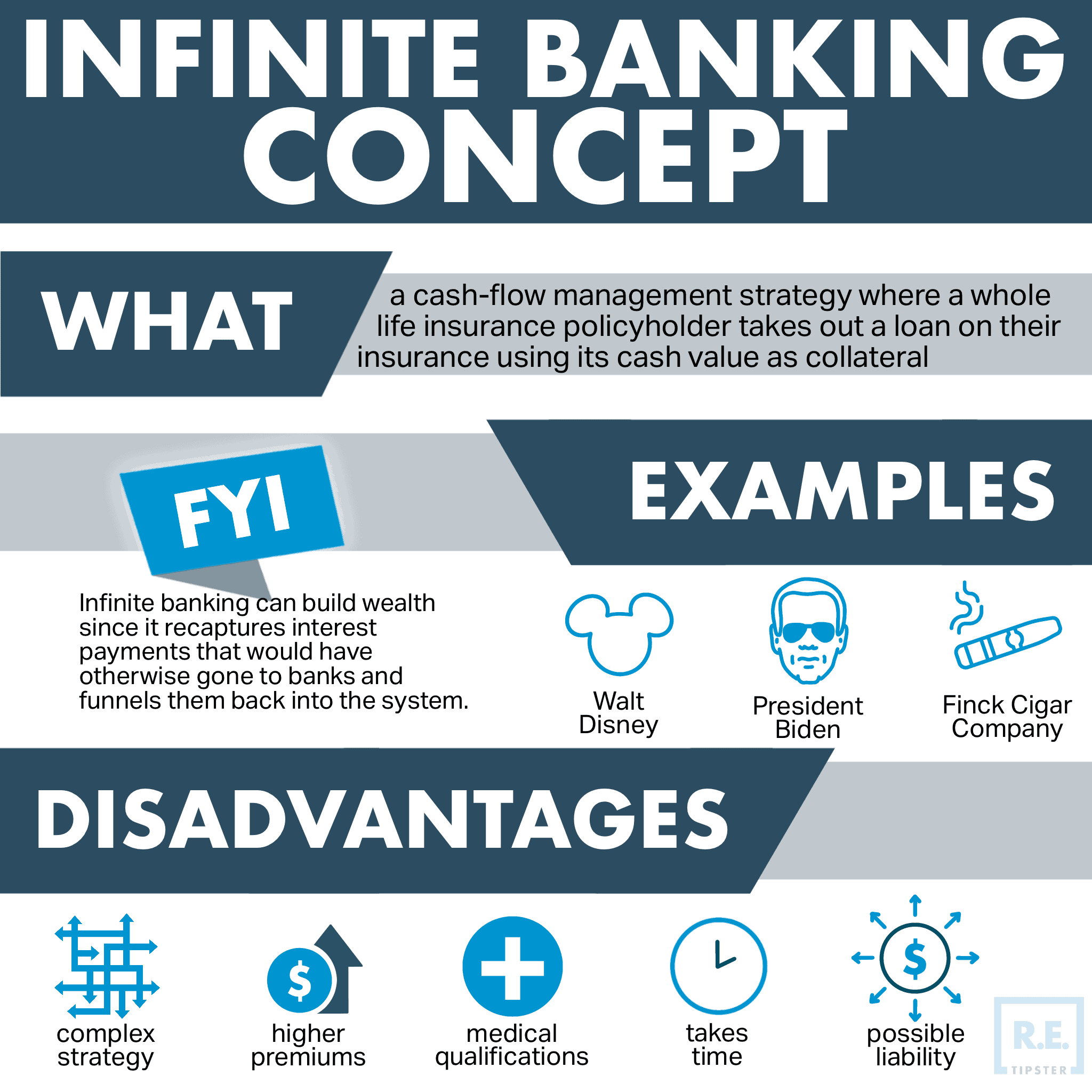

The idea of Infinite Banking was produced by Nelson Nash in the 1980s. Nash was a money specialist and fan of the Austrian institution of economics, which supports that the value of goods aren't explicitly the result of standard financial frameworks like supply and need. Instead, people value cash and goods in a different way based on their financial condition and needs.

One of the pitfalls of standard banking, according to Nash, was high-interest rates on financings. Long as financial institutions established the interest rates and lending terms, people really did not have control over their own riches.

Infinite Financial needs you to possess your monetary future. For ambitious individuals, it can be the best economic device ever before. Below are the benefits of Infinite Financial: Probably the solitary most advantageous aspect of Infinite Banking is that it enhances your money flow.

Dividend-paying whole life insurance policy is very low risk and provides you, the insurance holder, a fantastic offer of control. The control that Infinite Financial provides can best be organized right into two classifications: tax benefits and possession protections - become my own bank. Among the reasons entire life insurance is excellent for Infinite Financial is how it's strained.

Royal Bank Infinite Visa Rewards

When you utilize whole life insurance for Infinite Banking, you enter into a personal contract in between you and your insurance policy company. These defenses might vary from state to state, they can consist of security from possession searches and seizures, defense from reasonings and protection from lenders.

Whole life insurance coverage plans are non-correlated possessions. This is why they function so well as the economic foundation of Infinite Banking. No matter of what happens out there (stock, realty, or otherwise), your insurance plan preserves its well worth. Way too many individuals are missing this essential volatility buffer that aids safeguard and grow riches, rather splitting their cash into 2 containers: financial institution accounts and financial investments.

Market-based investments grow wealth much faster however are exposed to market fluctuations, making them inherently high-risk. What if there were a third container that offered security yet likewise modest, surefire returns? Whole life insurance policy is that third pail. Not just is the price of return on your entire life insurance policy policy ensured, your survivor benefit and costs are additionally assured.

This framework aligns flawlessly with the principles of the Perpetual Riches Approach. Infinite Financial allures to those looking for greater monetary control. Right here are its major advantages: Liquidity and ease of access: Policy financings offer instant access to funds without the restrictions of traditional financial institution fundings. Tax obligation effectiveness: The cash value expands tax-deferred, and policy financings are tax-free, making it a tax-efficient tool for building wide range.

Royal Bank Infinite Avion

Property security: In lots of states, the money value of life insurance is safeguarded from financial institutions, adding an added layer of economic safety. While Infinite Banking has its benefits, it isn't a one-size-fits-all solution, and it includes significant drawbacks. Below's why it may not be the most effective technique: Infinite Banking often calls for elaborate plan structuring, which can perplex insurance holders.

Picture never ever having to stress regarding bank fundings or high interest prices again. That's the power of unlimited banking life insurance.

There's no collection finance term, and you have the flexibility to select the payment schedule, which can be as leisurely as repaying the car loan at the time of fatality. This flexibility prolongs to the servicing of the loans, where you can choose interest-only settlements, maintaining the car loan equilibrium level and manageable.

Holding money in an IUL repaired account being attributed rate of interest can commonly be much better than holding the cash money on deposit at a bank.: You've always imagined opening your own bakeshop. You can borrow from your IUL policy to cover the first expenditures of leasing a room, buying tools, and employing personnel.

Standard Chartered Priority Banking Visa Infinite

Individual fundings can be acquired from traditional banks and lending institution. Below are some crucial factors to take into consideration. Bank card can offer an adaptable means to borrow cash for very temporary periods. Nevertheless, borrowing money on a credit rating card is usually really pricey with interest rate of passion (APR) commonly getting to 20% to 30% or even more a year.

The tax obligation treatment of plan lendings can vary considerably depending on your country of home and the particular terms of your IUL policy. In some areas, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, policy loans are normally tax-free, offering a substantial advantage. In various other jurisdictions, there may be tax obligation ramifications to think about, such as prospective taxes on the funding.

Term life insurance only gives a fatality benefit, without any money worth build-up. This suggests there's no cash value to borrow versus.

For financing policemans, the considerable policies enforced by the CFPB can be seen as difficult and limiting. Car loan policemans typically argue that the CFPB's laws produce unneeded red tape, leading to more paperwork and slower financing processing. Guidelines like the TILA-RESPA Integrated Disclosure (TRID) rule and the Ability-to-Repay (ATR) needs, while targeted at shielding customers, can lead to hold-ups in closing offers and raised operational costs.

Latest Posts

A Life Infinite

Dave Ramsey Infinite Banking Concept

Private Banking Concepts